There's a lot of chatter online about trading tools, and sometimes, you just want to know if something truly helps. People often wonder about how a particular service performs, how it feels to use, and whether it really makes a difference for their daily trading activities. It's a common question, and quite a fair one, to ask how something like Tradytics is working out for others who put their trust in it.

You see, someone in a trading group I'm part of, a Discord group actually, really stands by Tradytics. They seem to think it's an incredibly helpful resource, especially when it comes to understanding the flow of orders for options. This kind of firsthand account, honestly, can tell you a great deal about a tool's practical value. It suggests that for some, it's not just another piece of software; it's something they rely on, a key part of how they approach the markets.

Yet, it's also true that if a tool isn't proving its worth for you, then it's probably not something you should keep using. In the end, any tool you pick up, Tradytics included, is just one piece in your collection of things that help you make sense of the market. It's about finding what works for your personal style and what helps you feel more confident in your trading choices, so it's more or less a personal choice.

- Osinttechnical Twitter

- Kashmere Twitter

- Portia Paris

- %C3%A6 %C3%A5%C3%A4%C5%93 %C3%A5

- Mattbegreat Twitter

Table of Contents

- What Makes Tradytics Stand Out for Traders?

- How Does Tradytics Twitter Help with Market Insights?

- Getting to Grips with Tradytics' Data Tools

- Is the Tradytics Twitter Community Really That Good?

- A Look at Tradytics' Unique Approach

- What About Tradytics Twitter and Competitors?

- The Human Touch Behind Tradytics' Technology

- Tradytics Twitter - A Place for Shared Learning

What Makes Tradytics Stand Out for Traders?

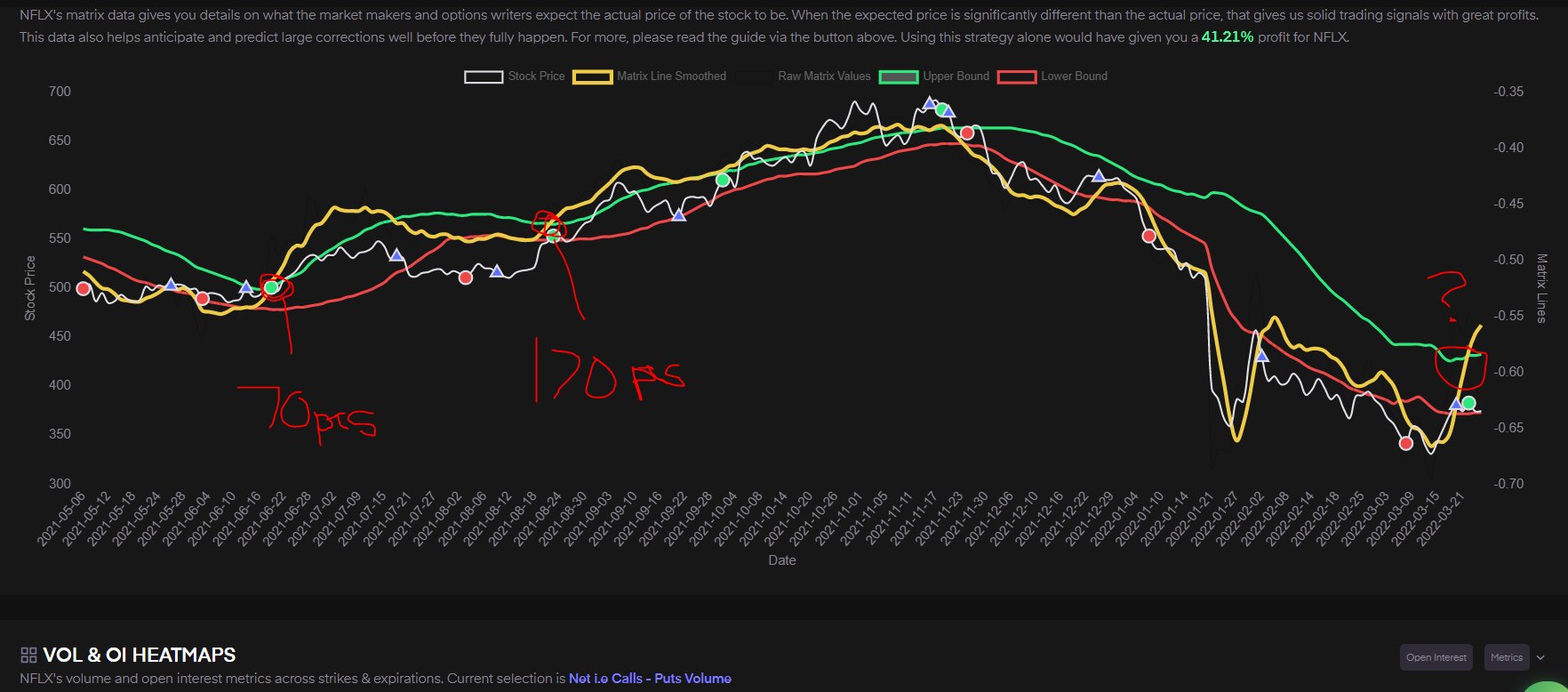

Tradytics, it seems, is a trading program that offers ideas and ways to look at stocks, options, and even crypto. The platform has many different dashboards, ways to scan the market, and other helpful items. It uses smart computer programs to look at past market information and find patterns. This helps it give you trade ideas that fit how much risk you are comfortable with and how you like to trade. It’s a bit like having a very sharp sense, one that has a lot of information backing it up. So, it really does try to give you an edge.

This tool is, in a way, a full trading platform that aims to bring together the insights often found in large financial institutions with what individual traders need. It takes information that might seem hard to figure out and makes it simpler, making it easier for everyday traders to use and act on. For instance, if you enter your account details, it can then begin to tailor its suggestions. It’s pretty clear that the goal is to make sophisticated trading more approachable for everyone, which is actually quite a nice idea.

How Does Tradytics Twitter Help with Market Insights?

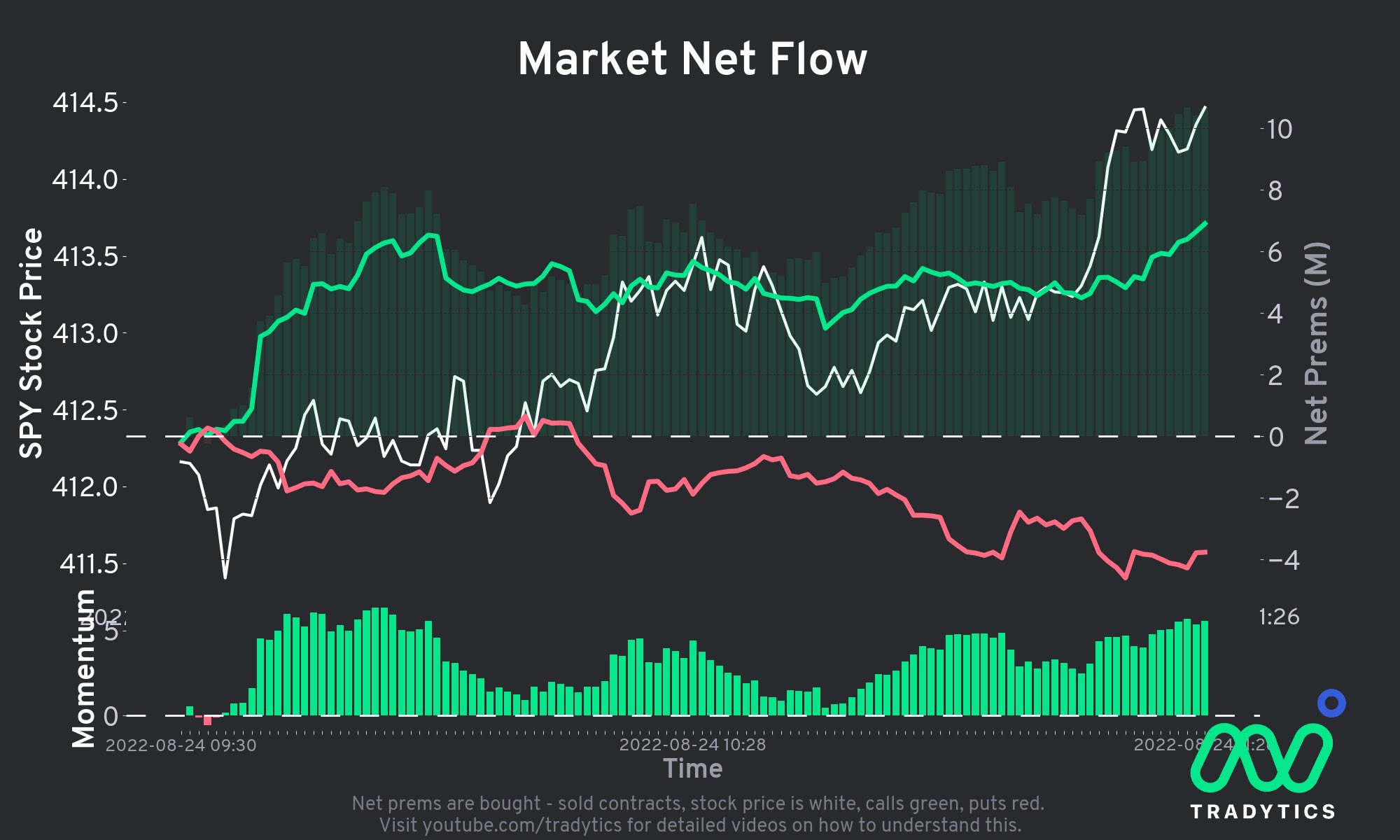

When we look at the information Tradytics gathers, we can arrange how people are placing their bets into two main types. There’s the overall grouping of positions, and then there’s how positions are set up based on when they expire. If this sounds a bit involved, don't worry about it too much; the platform is designed to make it less complicated. This kind of sorting, you know, can really help in seeing the bigger picture of what market participants are doing, which is often discussed on Tradytics Twitter. It gives a sense of where money is flowing.

Then there are these things called "block trades." These are large transactions that happen on regular exchanges, which means they are part of the public record. Tradytics, it appears, pays attention to these. It’s a way to keep an eye on what bigger players might be doing, because these large trades can sometimes signal important shifts. The platform has a tool, often called a "whale tracker," which is pretty neat. You can spot it by an eye icon at the top right of most pages. This tool helps keep tabs on these larger market participants, letting you see when they get into or out of positions. This information, honestly, is quite valuable for anyone trying to follow the big money, and it’s a topic that frequently comes up in discussions related to Tradytics Twitter.

Getting to Grips with Tradytics' Data Tools

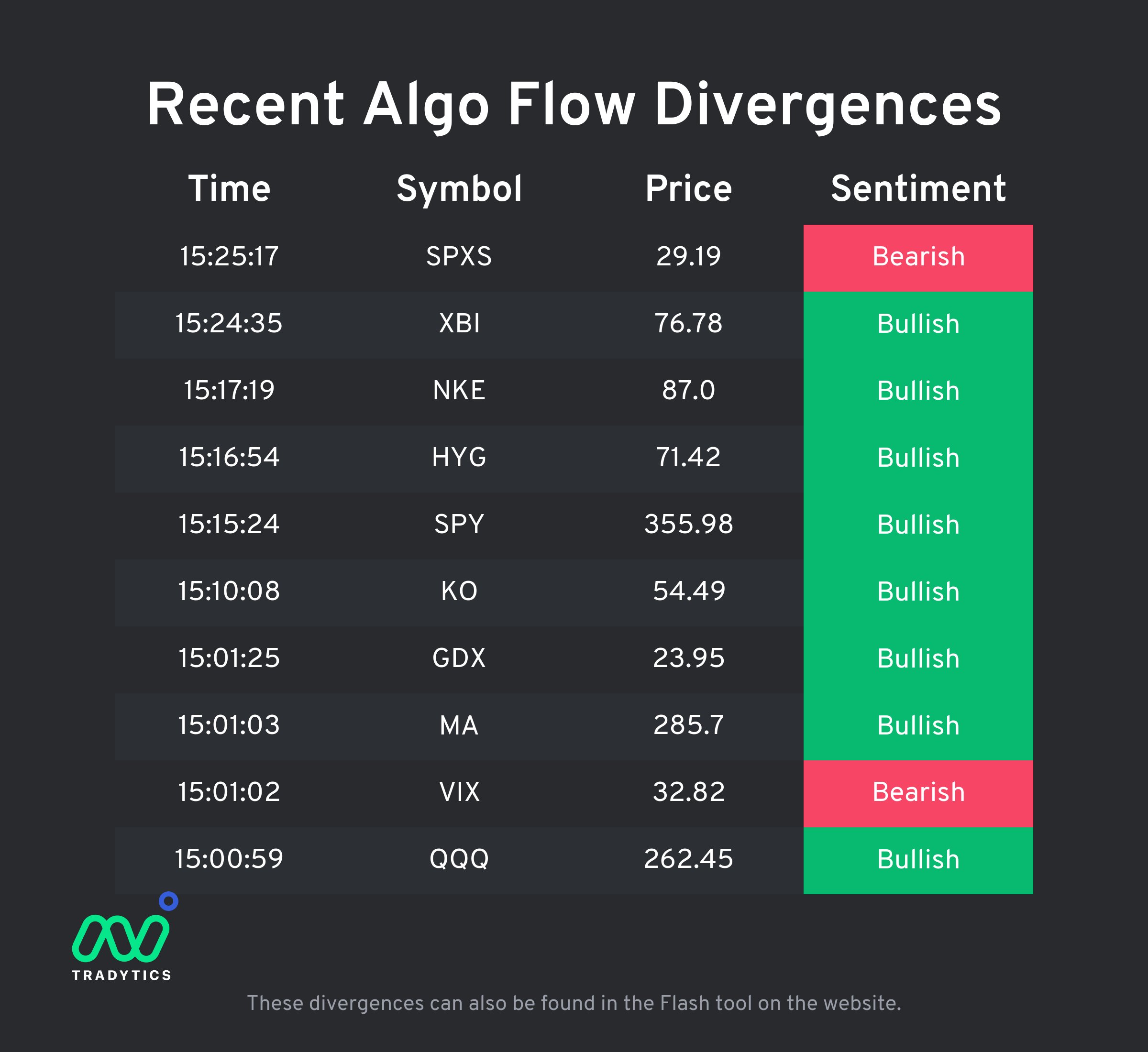

From what I gather, Tradytics is pretty good at what it does. I particularly appreciate the alerts it gives for what are called "divergence" and "golden sweeps." These alerts can be quite helpful in spotting potential trading opportunities. However, it's also very true that if you just follow these alerts without doing your own thinking and looking into things, it’s a bit like taking a chance, in my humble opinion. You need to combine the tool's suggestions with your own research to make truly informed decisions. This balance, you know, is really important for successful trading, and it's a topic often debated among users, sometimes on Tradytics Twitter.

The app's interface, the way it looks and feels to use, is something people have thoughts about. Some find it quite good. But what really stands out, it seems, is the community that has grown around Tradytics. This includes their Discord group, which is, apparently, far better than what you might find with some other services. For example, with a service like InsiderFinance, there isn't much of a community, so finding videos from users showing how they use it can be nearly impossible. The strength of the Tradytics community, therefore, adds a lot of value, providing a place where people can share insights and learn from each other, a place like Tradytics Twitter, for instance.

Is the Tradytics Twitter Community Really That Good?

The depth of information shared, like in a detailed post about customer positioning, combined with the honest way the Tradytics team talks about their product, really shows they know how to connect with people who use their tools. It’s a sign that they understand what their audience needs and how to communicate in a way that builds trust. Giving credit to them for using their smarts to build this connection is definitely in order. This kind of transparent communication, you know, is something that truly helps foster a helpful and engaged user base, which is quite evident if you follow discussions on Tradytics Twitter.

In a recent update from Tradytics, the focus was on how customers are positioning themselves in the market, all guided by data about options flow. The main interest was on two key types of this positioning. This kind of insight is quite specific and can be incredibly useful for traders trying to get a clearer picture of market sentiment. It highlights how the platform is always working to provide deeper, more relevant information to its users, which is, frankly, a good thing for anyone trying to stay ahead, and it's something that gets a lot of discussion on Tradytics Twitter.

A Look at Tradytics' Unique Approach

When you think about how Tradytics stacks up against other services out there, you might notice some differences. Many of their competitors tend to focus on just one main thing, like only options flow or just alerts. Tradytics, on the other hand, says it's different because its collection of tools is more comprehensive. This means it aims to give you a broader set of ways to look at the market, rather than just specializing in one area. This wider approach, you know, could be quite appealing to traders who want a single platform that covers many different aspects of their trading needs. It’s about offering a fuller picture, in some respects.

The platform uses artificial intelligence to scan the market and come up with trading ideas. These ideas are based on how much risk you are comfortable with and your particular way of trading. It's a bit like having a very smart assistant that understands your preferences and then sifts through a lot of data to find things that might interest you. This sort of personalized approach can really save a trader a lot of time and effort, especially if they don't want to spend hours doing research on what to trade, which is a common problem for many. So, it's pretty much about making things easier for the individual trader.

What About Tradytics Twitter and Competitors?

When considering Tradytics and how it compares to others, it's important to remember that many other services might excel in one specific area. For instance, some might be truly exceptional at providing options flow data, while others might be known for their alert systems. Tradytics, however, tries to bring many of these elements together into one cohesive platform. This means that instead of needing multiple subscriptions or tools, you might find a lot of what you need in one place. This integrated approach, you know, is something that sets it apart, and it's a point of discussion that often comes up when people talk about Tradytics Twitter versus other platforms.

The idea behind Tradytics is to offer a more complete set of tools, allowing traders to look at different aspects of the market without having to switch between various services. This can make the process of doing market research feel less fragmented. It’s about creating a single spot where you can get a wide range of insights. This broad utility, you know, is a key selling point for the platform, and it’s something that users often highlight when they discuss their experiences, especially when comparing notes on platforms like Tradytics Twitter.

The Human Touch Behind Tradytics' Technology

Despite all the talk about artificial intelligence and complex data, there's a very human element to Tradytics. The fact that the developer communicates in a clear and open way, as mentioned in the source text, shows a real desire to connect with the users. This isn't just about throwing data at people; it's about explaining what the data means and how it can be used. This kind of straightforward talk, you know, helps build trust and makes the whole experience feel more approachable. It's not just about the numbers; it's about the people using them.

For someone like me, who works with data for a living and enjoys trading every now and then, the appeal of a tool like Tradytics is quite clear. I don't want to spend endless hours digging for information on what to trade. That's where a tool that simplifies things comes in handy. It’s about getting good insights quickly, so you can spend less time researching and more time doing other things. This focus on efficiency for the user, you know, is a big part of what makes the platform appealing, and it's a sentiment often echoed by others who share their thoughts, perhaps on Tradytics Twitter.

Tradytics Twitter - A Place for Shared Learning

The community aspect, especially the Discord group and the discussions that spill over to places like Tradytics Twitter, truly adds another layer of value. It's one thing to have a tool that gives you data, but it's another entirely to have a place where you can talk about that data with others, share what you're seeing, and learn from different viewpoints. This shared learning environment can be incredibly helpful for traders of all levels. It's a place where questions can be asked, experiences can be swapped, and collective wisdom can grow. This kind of interaction, you know, is quite important for anyone looking to improve their trading skills.

The transparency from the developers, combined with an active user base, creates a sense of shared purpose. It’s not just about using a tool; it’s about being part of a group that’s all trying to get better at understanding the markets. This collaborative spirit, you know, can make a big difference in a field that can sometimes feel quite solitary. So, in many ways, the community around Tradytics, including the conversations on Tradytics Twitter, is as important as the features of the platform itself, offering support and insights that go beyond just the software. It’s a rather helpful ecosystem, in some respects.

In summary, Tradytics offers a trading program that provides trade ideas and ways to look at stocks, options, and crypto. It uses smart computer programs to analyze market data and give suggestions based on your risk comfort and trading style. The platform has a "whale tracker" tool to follow large trades and helps sort customer positioning into overall and expiration-based categories. While it offers useful alerts like "divergence" and "golden sweeps," it encourages users to combine these with their own analysis. A key strength is its active community, particularly the Discord group, which provides a place for shared learning and discussion, a sentiment often reflected on Tradytics Twitter. Unlike some competitors that focus on single themes, Tradytics aims to offer a broader set of tools. The platform tries to make complex trading information easier to use, bridging the gap between professional insights and individual traders' needs, all while maintaining an open and communicative approach with its users.