Figuring out what you owe on your digital assets can feel like a real puzzle, can't it? For many folks and businesses dealing with cryptocurrencies, the whole idea of tax compliance often brings a wave of worry. Happily, there's a group dedicated to making this often-tricky process much simpler, helping you stay on the right side of the rules without all the usual stress.

This particular group offers specialized assistance with tax compliance and advice for anyone, whether you are an individual or a company, who holds or uses digital assets. They aim to clear up the confusion that sometimes comes with these newer forms of money and investments, ensuring you can manage your financial obligations with a bit more ease. It’s almost like having a friendly guide show you the way through a somewhat dense forest of rules.

Their main purpose, you see, is to help you move from feeling overwhelmed to feeling quite confident about your tax filings. They understand that the world of digital money is always moving, and they work to keep pace with it, offering solutions that are genuinely helpful for today's market. So, if you've been wondering how to handle your crypto earnings or trades, you might find their approach quite refreshing.

Table of Contents

- Meet Ernest - A Guiding Hand in Tax Matters

- Ernest's Background and Expertise

- What Makes Decrypted Tax Different?

- How Does Decrypted Tax Simplify Your Crypto Filings?

- Can Decrypted Tax Help with State and Local Forms?

- Why Is Crypto Tax So Important Right Now?

- What Happens If You Don't Report Crypto with Decrypted Tax?

- Who Benefits from Decrypted Tax's Approach?

Meet Ernest - A Guiding Hand in Tax Matters

When you're dealing with something as important as your money matters, especially those tied to digital assets, it's really comforting to know there's an experienced person at the helm. Ernest is one of the key people behind this effort, serving as a partner at the firm. He brings a significant amount of professional wisdom to the table, which is very reassuring for anyone feeling a little lost in the tax paperwork.

His involvement means that the advice and services you receive are built on a solid foundation of real-world experience. He has spent a good deal of his career, over two decades actually, working within the specifics of tax rules and how money accounts are kept. This kind of background is just what you want when trying to make sense of your financial picture, especially with all the new digital currency rules appearing. He is, you know, a very seasoned professional.

Ernest's Background and Expertise

Ernest's professional journey shows a deep commitment to helping people with their tax situations. He has spent more than twenty years immersed in the details of tax rules and accounting practices, which gives him a truly broad view of financial requirements. This extensive period of working with numbers and regulations means he has seen quite a bit, and learned a lot about what works best for people and businesses.

His particular strengths lie in several important areas. He has a very strong grasp of general tax rules, which is, you know, a fundamental requirement. Beyond that, he also possesses a deep understanding of how state tax plans work, which can often be different from federal ones. Most importantly for today's market, he's become quite skilled in the specific area of crypto taxation. This means he has helped a good many people figure out the sometimes-tricky and always-changing tax rules that apply to digital money, making sure they stay compliant and feel secure.

| Detail | Information |

|---|---|

| Name | Ernest |

| Role | Partner at Decrypted Tax |

| Experience | Over 20 years in tax law and accounting |

| Key Skills | Tax law, state tax planning, crypto taxation |

| Specialization | Helping clients with digital asset tax regulations |

What Makes Decrypted Tax Different?

You might be wondering what sets this particular service apart from others, especially when there are so many options out there for handling your money. Well, the key difference with Decrypted Tax is their sharp focus on digital assets. They aren't just a general tax service; they truly specialize in the unique situations that come with cryptocurrencies, NFTs, and other digital holdings. This specialization means they understand the specific quirks and rules that apply to your crypto activities, which is quite helpful.

Their approach is built around making your tax season less of a headache and more of a smooth experience. They’ve really focused on taking the stress out of organizing and filing your crypto-related taxes. It’s about transforming what can often feel like a burden into something manageable, giving you a sense of calm and assurance as you meet your tax obligations. They aim to make the process feel, you know, almost effortless.

How Does Decrypted Tax Simplify Your Crypto Filings?

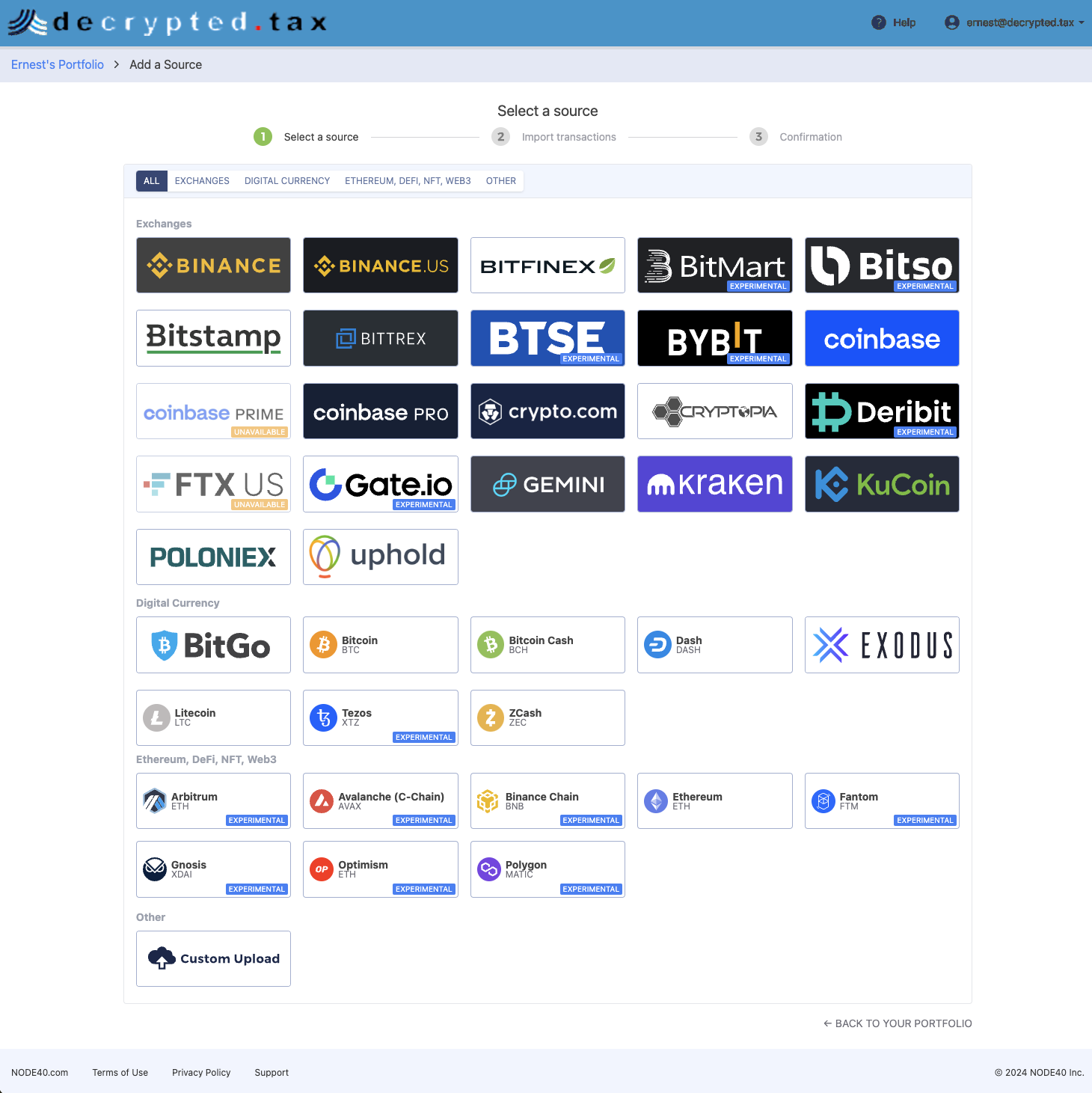

The core of what Decrypted Tax does to make things easier for you lies in their clever use of technology. They have created tax software that genuinely simplifies the way you handle your cryptocurrency information. This isn't just about making things look pretty; it's about making the actual process of gathering and reporting your digital asset activity much more straightforward. So, it's not just a little bit helpful, it's a lot.

Their system works by automating the creation of accurate tax reports. This means you don't have to spend hours manually figuring out every single transaction. The software does the heavy lifting, ensuring that the reports it generates follow all the local rules and regulations. Whether you're trying to report earnings from selling digital coins, money made from "staking" your assets, or even gains from decentralized finance activities, they aim to make it simple for you. It's really about taking the guesswork out of it.

They track the entire journey of each transaction you make with your digital money. This means they follow it from the very beginning, when you first acquire it, through any transfers you might make, and right up to when you eventually sell or use it. This careful tracking allows them to give you very precise calculations for your tax forms, which in turn gives you complete confidence in your filings and helps ensure you are fully compliant with all the necessary rules. You see, they really focus on the details.

Can Decrypted Tax Help with State and Local Forms?

A common question people have about their taxes, especially when dealing with something relatively new like digital assets, is whether a service can handle all the different layers of government requirements. It’s not just about federal taxes, after all; states and even local areas often have their own specific rules. Decrypted Tax understands this, and they genuinely aim to cover all your bases, which is quite important.

Yes, they do assist with the preparation of state and local tax forms. This means you won't have to piece together information from different sources or try to figure out varying requirements on your own. They work to save you time by handling these details, and just as importantly, they strive to keep your tax payments as low as possible across all levels – state, local, and federal. This comprehensive approach means you get a more complete picture of your tax situation, which is quite a relief for many people.

Beyond just preparing forms, they offer some really useful extras. This includes free tracking of your digital money portfolio, which helps you keep an eye on your assets throughout the year. They also provide a professional review of your tax documents, giving you an extra layer of assurance that everything is correct. Plus, they don't limit you on the number of exchanges, digital wallets, decentralized finance platforms, or even NFTs you use; they cover them all. It’s a pretty thorough service, actually.

Why Is Crypto Tax So Important Right Now?

With tax deadlines always approaching, or sometimes seemingly just around the corner, it’s a good time to think about why paying attention to your digital asset taxes is so crucial. The rules around cryptocurrency and taxation are becoming clearer, and the government is certainly paying more attention. It's not just a suggestion to report your crypto activity; it’s a requirement, and the consequences for not doing so can be pretty serious, you know.

The Internal Revenue Service, the IRS, views cryptocurrencies in a particular way. In their eyes, digital money is generally considered property, much like stocks or real estate. This means that when you spend your cryptocurrency, or trade one type for another, those actions can trigger a tax event. It’s not just about selling for traditional money; any disposition of your digital assets can have tax implications. So, in a way, it's treated quite similarly to other investments you might have.

Whether you’re just dabbling in some popular, perhaps a bit humorous, digital coins, or you're deeply involved in the complex world of decentralized finance, understanding your tax responsibilities is genuinely important. The IRS has penalties for transactions that go unreported. These can include financial fines, which nobody wants, and in some very serious situations, even time in prison. This is why getting your crypto taxes right isn't just about following the rules; it’s about protecting your financial well-being and your freedom, really.

What Happens If You Don't Report Crypto with Decrypted Tax?

Ignoring your crypto tax obligations, or simply not knowing how to handle them, can lead to some uncomfortable situations with the tax authorities. As we just mentioned, the IRS is quite clear that digital currencies are taxable assets, and they expect you to report them. If you don't, there are definite consequences that can impact your finances and, in extreme cases, your personal liberty. It’s a pretty serious matter, actually.

The penalties for not reporting your cryptocurrency transactions can be quite substantial. You could face fines that add up quickly, making your financial situation more difficult. And while it's less common, for very serious or intentional omissions, there is even the possibility of prison time. This is why it's so important to be proactive and ensure your filings are complete and accurate. It’s not something you want to leave to chance, you know.

Decrypted Tax aims to help you avoid these kinds of troubles entirely. By providing precise calculations and ensuring full compliance, they give you a strong sense of confidence that your tax reports are correct. This means you can breathe a bit easier knowing you’ve met your obligations and are less likely to face scrutiny from the tax agency. They really want to help you stay out of hot water.

Who Benefits from Decrypted Tax's Approach?

A variety of people and groups can find real value in the services offered by Decrypted Tax. Their specialized focus means they are particularly helpful for anyone who has stepped into the world of digital assets, whether they are just starting out or have been involved for a while. They genuinely aim to make things simpler for a broad range of users, which is quite a benefit.

For example, they specifically mention helping followers of groups like the Piper Academy and the HIT Network save as much as possible on their crypto and decentralized finance taxes. This shows their commitment to reaching out to communities that are actively engaged in the digital asset space. They aim to save these individuals not only money by minimizing their tax payments but also a lot of precious time, which is, you know, invaluable.

Beyond these specific communities, anyone who finds crypto taxes complicated can benefit. They acknowledge that these taxes can be tricky, but they firmly believe they don't have to be overwhelming. Their goal is to simplify the process and help you get the largest possible return or minimize what you owe. Since they truly specialize in crypto, NFTs, and decentralized finance, they are well-placed to handle your specific needs, allowing you to put your attention back on the market itself. It’s a pretty straightforward benefit, really.

In fact, many people have found their services to be quite rewarding. There’s feedback that suggests working with them "pays off," with individuals experiencing "big cash outs" and describing their week with the platform as "great." People have expressed "wonderful feedback," feeling that their tax season was transformed "from stressful to seamless." This kind of direct positive experience speaks volumes about the value they provide, helping crypto investors organize and file with a real sense of confidence. So, it's not just talk, you see.

The firm itself was established because Ernest and his trusted colleague saw that crypto taxation was becoming increasingly involved. They recognized a clear need for specialized help in this area, which led them to create a service that could truly address these growing challenges. This background means their services are rooted in a deep understanding of the problem they are trying to solve, which is quite important for providing effective solutions.

Their services are also quite accessible, covering various popular digital asset networks. This includes Solana, Ethereum, Bitcoin, Base, and Sui. This broad coverage means that no matter which of these platforms you use for your digital asset activities, Decrypted Tax is set up to assist you with your tax reporting. It’s a very practical aspect of their service, actually.

If you're looking for their physical location, they are situated at 5184 W Industrial Drive, in Hurricane, Utah, with the postal code 84737 in the United States. This provides a tangible point of contact for their operations, showing they are a real business with a physical presence. It’s just another detail that adds to their credibility.

It's also worth noting that while crypto taxes can seem complicated, there was a positive development regarding the IRS safe harbor compliance law, which got pushed back until 2026. This extension gives people a little more breathing room, but it doesn't mean you can ignore your obligations. Decrypted Tax is still here to simplify things and help you make the most of your tax situation, even with these changes. They really aim to make it less overwhelming for you.

Ultimately, the goal of Decrypted Tax is to take the burden of digital asset taxation off your shoulders. They want you to feel secure and confident about your filings, knowing that experienced professionals are handling the details. This allows you to focus on what you really want to do, which is often engaging with the market and your investments, rather than worrying about paperwork. It’s a very straightforward proposition, really, offering peace of mind in a sometimes turbulent financial world.

- Paige Turnah Twitter

- Ianandmariah Twitter

- %C3%B8%C3%BA%C3%B8%C3%BB%C5%93 %C3%B8%C3%B9%CB%86%C3%B9%C3%B8%C3%B9%C3%B8%C3%BB%C5%93

- Osinttechnical Twitter

- Angelina Castro Twitter