You might hear the name Coi Leray Babcock and immediately think of vibrant music, catchy beats, and a truly unique style. But what if we told you there's another kind of "COI" that brings a different, yet equally important, sense of security, especially for anyone building something great or running their own show? It's not about hitting the charts, but about having your paperwork in order, the kind of documentation that helps protect your dreams and efforts. We're talking about something quite important for folks who manage their own ventures, or even just need to make sure they're covered when working with others, you know?

This other "COI" is a little piece of paper, or sometimes a digital file, that acts like a quick snapshot of your insurance coverage. It's almost like a badge of trust, a way to show that you've got things handled when it comes to potential bumps in the road. Think of it as a simple, straightforward way to confirm you're prepared for whatever comes your way, whether you're a small business owner, a contractor, or someone renting out a space, as a matter of fact.

So, while the name Coi Leray Babcock might conjure up images of creative flair and artistic freedom, we're going to chat about a very different kind of "COI" – one that's all about making sure your business dealings are smooth and secure. It's a key part of staying protected, and honestly, it's pretty simple to get your head around once you know what to look for, actually.

- Twitter Chase

- Hand Job Twitter

- Cinna Twitter

- %C3%A6 %C3%A5%C3%A4%C5%93 %C3%A5

- %C3%B8%C3%BA%C3%B8%C3%BB%C5%93 %C3%B8%C3%B9%CB%86%C3%B9%C3%B8%C3%B9%C3%B8%C3%BB%C5%93

Table of Contents

- What's This "COI" Everyone Talks About?

- Is a COI Really That Big a Deal for Coi Leray's Projects?

- Getting Your Hands on a COI - How Does That Work?

- Who Needs a COI - And Why Should Coi Leray Care?

- Beyond Proof - What Does a COI Actually Show?

- How Can Aspel COI Help Someone Like Coi Leray?

- Keeping Up with COI - What's New and What's Next?

What's This "COI" Everyone Talks About?

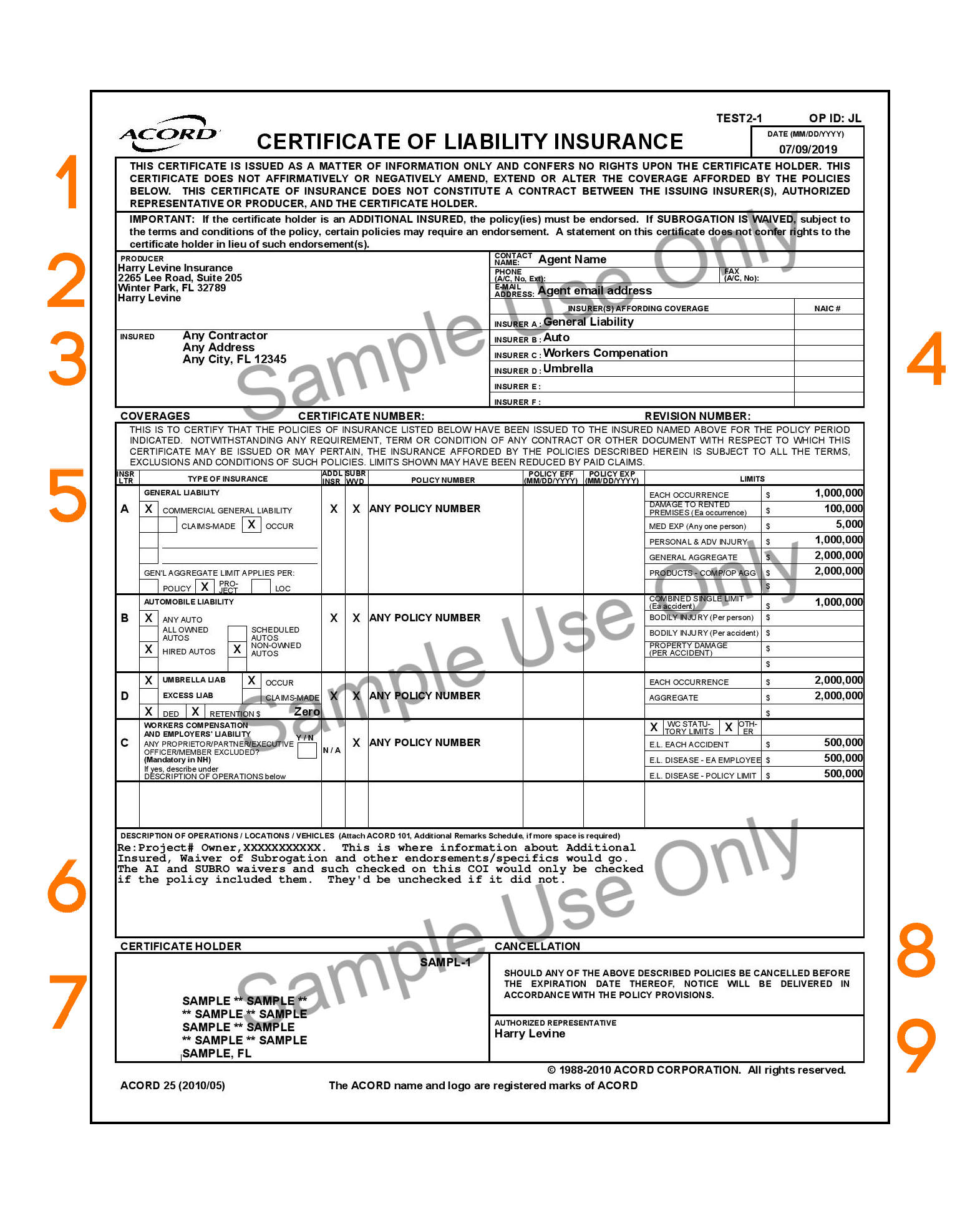

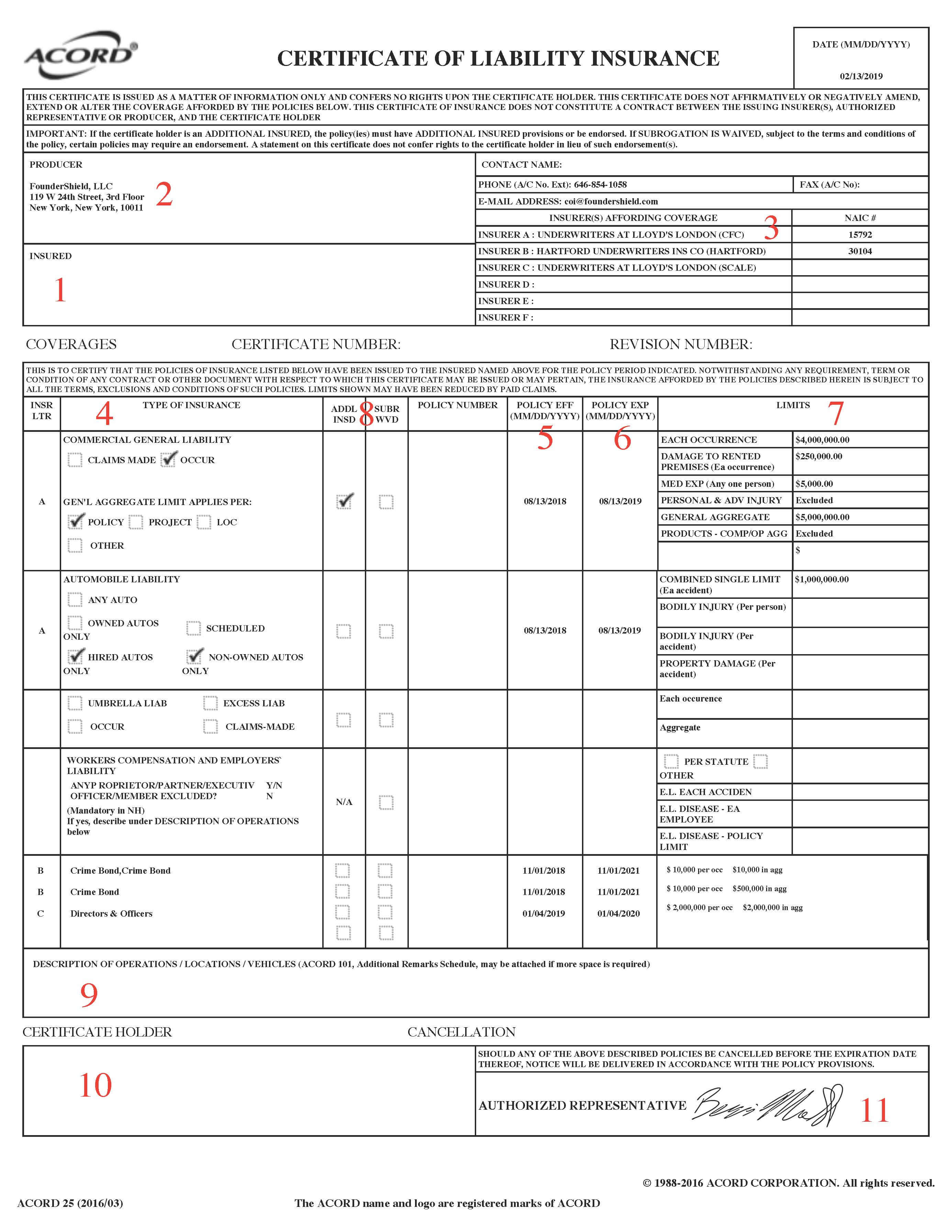

Alright, so let's get down to what a Certificate of Insurance, or COI, actually is. Basically, it's a piece of paper, or a digital document, that an insurance company or a broker gives you. It's not the actual insurance policy itself, mind you, but rather a quick snapshot, a summary of your coverage. Think of it like a quick ID card for your insurance. It shows that you have an active insurance policy, which is pretty much the main thing. It's also sometimes called a certificate of liability insurance or just proof of insurance, you know? It's typically just one page long, so it's not a huge stack of papers to sift through, which is nice.

This document is issued by your insurer, and it simply verifies that an active insurance policy is in place. It's a formal way of saying, "Yes, this person or entity is covered." For example, if Coi Leray were to launch her own clothing line and needed to work with various suppliers or venues, they might ask for this very document. It's about making sure everyone involved feels secure. The COI essentially confirms the existence of an insurance policy and provides a brief overview of what that policy covers. It’s a very simple concept, really, but it carries a lot of weight in the business world.

The main idea behind a COI is to give peace of mind to other parties you're working with. It lets them know that if something goes wrong, like an accident or an issue that causes financial trouble, you have insurance to help cover it. It's a way to show you're responsible and that you've taken steps to protect against certain risks. So, it's not the policy itself, but more like a brief, official note confirming your coverage. It’s a pretty standard request in many business dealings, actually.

Is a COI Really That Big a Deal for Coi Leray's Projects?

You might wonder, "Is this COI thing really that important for someone with creative projects, like if Coi Leray was, say, putting on a big concert or starting a new venture?" And the honest answer is, yes, it truly is a big deal. Proof of insurance is absolutely essential for small businesses and contractors. It helps prevent a lot of potential risk and liability. Without it, you could be on the hook for unexpected costs if something goes sideways. This document helps protect everyone involved, which is why it's so often requested. It gives others confidence that you're prepared, you see.

Think about it this way: if Coi Leray's team was setting up a stage for a show, and a piece of equipment accidentally caused damage to the venue, who pays for that? If she has the right insurance and can show proof of it with a COI, then her insurance might step in to cover the costs. Without that proof, the venue might be hesitant to even let her set up. So, it's not just about covering accidents, but also about building trust and making sure business relationships can even happen. It’s a pretty basic step in risk management, more or less.

The COI includes some key details that others will want to see. It lists your specific coverage, the limits of that coverage, and the dates when your policy is active. While it's not the full policy, it gives a clear picture of what's in place. So, for any project, big or small, having this document ready means you're prepared and can show others you're a reliable partner. It’s a pretty straightforward way to handle things, and honestly, it can save a lot of headaches down the road. It’s just good practice, you know?

Getting Your Hands on a COI - How Does That Work?

So, if you realize you need one of these COIs, how do you actually get it? Well, it's fairly simple. A Certificate of Insurance is issued by your insurance company or your insurance broker. You just need to reach out to them and ask for it. They're the ones who hold all the details of your policy, so they're the only ones who can officially create this document for you. It's not something you can just whip up yourself, which is kind of important for its credibility, you see.

When you ask for a COI, your insurer will put together that one-page summary that verifies you're covered by an insurance policy. They'll include all the necessary information, like your policy number, the types of coverage you have, and how much coverage you have for different situations. If, for instance, Coi Leray needed to provide proof of insurance to a landlord for a new studio space, her insurance company would prepare that document for her. It's a pretty quick process, typically, once you make the request.

It’s a good idea to know what you're looking for when you request a COI, or when you receive one from someone else. You'll want to make sure it lists the correct policy details and that the coverage is what you expect. It's basically a confirmation that everything is in order. So, if you're ever asked for proof of insurance, just remember to contact your insurer or broker, and they'll get that COI ready for you. It's pretty much their job, after all.

Who Needs a COI - And Why Should Coi Leray Care?

You might be wondering who exactly needs one of these Certificates of Insurance. Is it just for big corporations, or does it apply to everyday folks and smaller ventures? The truth is, a wide range of people and businesses use them. Small businesses, contractors, freelancers, and even individuals who are renting out property or equipment often need a COI. It's essentially proof of insurance to help you grow your business and protect yourself. For someone like Coi Leray, if she's working with different venues, collaborating with other artists, or even hiring people for her team, she'd want to understand this.

Clients, landlords, and business partners often ask for a COI. They want to see that you have general liability insurance, which is what these certificates often show. For example, if Coi Leray was booking a venue for a private event, the venue owner would almost certainly ask for a COI to make sure she's covered in case someone gets hurt or property gets damaged during the event. It’s a way for them to protect their own interests, too, you know?

A COI verifies that a person or entity is covered by an insurance policy. It's a straightforward way to confirm that you've taken steps to manage potential risks. So, whether you're a budding entrepreneur, a seasoned contractor, or someone managing creative projects, understanding what a COI is, how it's used, and why it's important can really help you out. It’s a pretty common document in many dealings, honestly, and knowing about it just makes things smoother.

Beyond Proof - What Does a COI Actually Show?

While a Certificate of Insurance is, at its core, proof of insurance, it actually shows a bit more than just "yes, they have insurance." It includes specific policy details. For instance, it lists your specific coverage types, the limits of that coverage, and the effective dates of your policy. This means it tells you what kinds of situations your insurance will help with, how much it will pay out, and when the policy is active. It's a pretty concise way to get the essential facts about someone's coverage, you see.

Let's say Coi Leray's team is hiring a new sound engineer. That engineer, if they're an independent contractor, might provide a COI. When Coi's team reads through that COI, they'll want to make sure the engineer has the specific insurance coverage they're looking for, like professional liability or general liability, and that the coverage amounts are sufficient. It's about checking that the person or company you're working with has adequate protection, which in turn, offers a layer of protection for you too, in a way.

So, it’s not just a blank check saying "insured." It's a document that gives you a glimpse into the specifics of the policy. It's like looking at a quick summary sheet before reading a whole book. It helps you quickly verify that the coverage is appropriate for the task at hand. This is why it’s so important to actually read the COI you receive, or to make sure the one you provide accurately reflects your coverage. It’s pretty important for transparency, actually.

How Can Aspel COI Help Someone Like Coi Leray?

Now, shifting gears a little, there's also something called Aspel COI, which is a software system. This is completely different from a Certificate of Insurance document, but it uses the "COI" acronym because it's about accounting and managing financial records. For someone like Coi Leray, who might have a growing business, a brand, and various financial transactions, this kind of software could be incredibly helpful. It’s about keeping track of money coming in and going out, and making sure everything is recorded properly, which is pretty vital for any successful venture.

Aspel COI helps you with mass accounting for CFDI (Comprobante Fiscal Digital por Internet) records. This means it can quickly process many digital tax receipts, creating dynamic accounting entries and helping you manage your receipts quickly and accurately. Imagine if Coi Leray had tons of invoices and expenses from tours, merchandise sales, and collaborations; a system like Aspel COI could really streamline that process. It's about taking what can be a very manual and time-consuming task and making it much faster, you know?

This software helps organize and record fiscal receipts from your operations. It can even connect with other Aspel systems and services, helping you generate accounting entries for sales, purchases, and other movements. With something like Siigo Nube plus Aspel COI, you get to really own your accounting. You can access your clients' financial movements to download documents you need to check before sending them off to the tax authorities. It's a way to keep all your financial ducks in a row, which is pretty much what any growing business needs, honestly.

Controlling the accounting and operations for your clients becomes much simpler with this accounting software. With just one license, you can manage the accounts for all the companies you handle. This is a pretty big deal for accountants or business managers who oversee multiple entities, like if Coi Leray had several different business ventures under her umbrella. It helps you save time and makes the whole accounting process much smoother, more precise, and efficient. You get direct access to CFDI files, too, filtering them by type and entity, which is very handy.

Aspel COI is also designed to help meet new requirements for financial reporting. It makes it easier to record third-party data and related transactions, including taxes. So, it’s not just about basic record-keeping, but also about staying compliant with regulations, which is pretty important. To get all the features working, you just need to activate the system, following a few steps. It’s all about making the complex world of accounting a little less complicated, which is what any busy person, like Coi Leray, could really use, basically.

Keeping Up with COI - What's New and What's Next?

Staying current with how these COIs work, both the insurance certificates and the accounting software, is pretty important. In the world of Aspel COI, for example, they often release updates and improvements. These are made to make your experience even better and to help you optimize your daily operations. So, it's not a static tool; it's something that gets refined over time to serve users better. This continuous improvement means you're always getting the best possible features, you know?

For those using Aspel CO