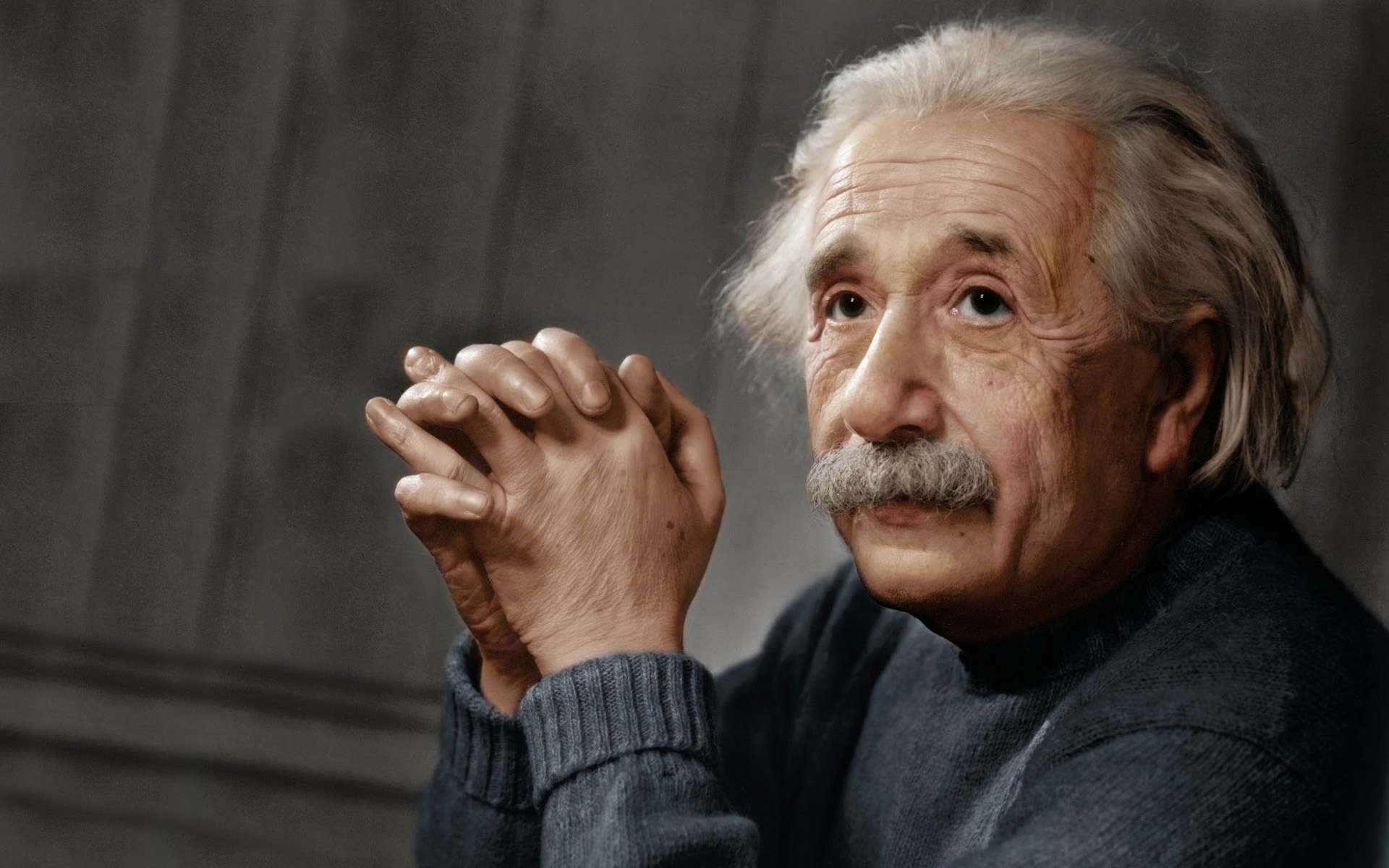

It's quite common for folks to wonder about different things, and sometimes, that includes details about individuals or even the origins of helpful tools we use every day. When we talk about "Albert Posis age," it might make you think about a person, perhaps someone well-known. However, the information we have right here points us to something a little different, yet very much connected to helping people with their daily lives. We're actually going to talk about a very popular financial tool, which many people simply call "Albert." This particular "Albert" is a financial companion that has been helping millions get a better grip on their money matters, and in a way, we can talk about its "age" in terms of its maturity and how long it's been around for people to use.

This digital helper, which is a bit like having a money guide right in your pocket, has made a real impact on how people look after their earnings and outgoings. It's a system that helps you sort out your money, put some away for later, spend wisely, and even make some investments, all from one spot. So, while you might have been curious about a person named Albert Posis and their time on this earth, our conversation today will center on this particular financial service and how it assists so many individuals in their quest for better money management. It's truly a useful resource for anyone looking to simplify their financial routine, and it's been around for a good while, helping quite a lot of people.

More than ten million people, you see, have already chosen to use this Albert, making it a rather widely accepted way to handle personal finances. It's a straightforward approach to managing your funds, whether you're just starting out or you've been working with money for quite some time. The goal is to give you a clear picture of where your money goes and where it could be going, helping you feel more confident about your financial future. It's almost like having a friendly expert always ready to offer some guidance on your spending and saving habits, and it has certainly gained a lot of traction over its years of operation.

Table of Contents

- What's the Real Story with Albert and Financial Well-being?

- Who is Albert, Anyway, and What's Their Age in the Financial World?

- Taking Charge of Your Money - Is This for Every Age Group?

- Getting Started with Albert - A Simple Step for Any Age

- What Does Albert Offer - Beyond Just Saving Money at Any Age?

- Albert's Place in the Financial Scene - Not a Bank, But What Then?

- Keeping Tabs on Your Spending - A Smart Move for All Ages

What's the Real Story with Albert and Financial Well-being?

So, when we talk about Albert, we are really talking about a financial application that lives on your phone, helping you get a solid grasp on your personal funds. This handy tool is designed to assist you with a few key aspects of your money life: making a budget, putting aside cash, spending wisely, and even making some investments. It’s all contained within one remarkably effective system. Many people, more than ten million actually, have already chosen to use this Albert service to manage their financial journeys today. It's a very popular choice for those looking to simplify their money management, and it seems to be growing in popularity quite consistently. The real story here is about making financial well-being more reachable for everyone, regardless of their current situation or, you know, their actual age.

The service offers various plans, which range in cost from about eleven dollars and ninety-nine cents each month to twenty-nine dollars and ninety-nine cents per month. This means there are options for different needs and perhaps different levels of support you might want for your money matters. What’s nice, too, is that you can give a plan a try for thirty days before you are asked to pay anything. This gives you a good chance to see if it fits with how you like to handle your money. It's a pretty fair way to introduce people to the service, allowing them to experience its benefits before committing fully. This approach helps people feel more secure about trying something new, which is definitely a positive for a financial tool.

Who is Albert, Anyway, and What's Their Age in the Financial World?

As we've touched on, Albert isn't a person like Albert Posis, but rather a very useful piece of software that helps you with your money. So, when we ask about its "age" in the financial world, we're really thinking about how long it's been around and how much it has matured as a service. It has, you know, been around long enough to gather a user base of over ten million individuals. That number alone tells you a lot about its presence and, perhaps, its longevity in the very busy financial technology space. It means it's not a brand-new player, but rather one that has established itself as a reliable helper for many. Its continued growth suggests a certain stability and a proven track record, which is pretty important when you're dealing with something as personal as your money.

The growth to over ten million users suggests a significant period of development and refinement, meaning it's certainly past its early stages. It has, for instance, learned a lot from its user base over time, adapting to what people truly need from a financial helper. This kind of experience, you could say, is its "age" in the industry. It's a tool that has grown up a bit, moving from a fresh idea to a widely used and trusted companion for daily money management. This maturity means it has likely smoothed out many of the little bumps that new applications often face, offering a more polished and dependable experience for everyone who chooses to use it. It's almost like a seasoned guide for your money.

Taking Charge of Your Money - Is This for Every Age Group?

When you think about getting a better handle on your money, it's a topic that really touches everyone, no matter how many years they've lived. So, is this Albert service something that can help people of, let's say, any age? Absolutely. Whether you're just starting out in your first job, perhaps in your twenties, or you're getting ready for retirement in your fifties or sixties, managing your money is a constant need. This tool is set up to assist a wide range of people with their financial goals. It's about providing clear insights and simple ways to budget, save, spend, and invest, which are pretty universal needs across all life stages. You know, everyone wants to feel more secure about their money, and this app aims to make that feeling more accessible.

For younger individuals, it might be about learning how to put aside cash for a first big purchase or understanding how to track their spending habits. For those a bit older, it could be about optimizing savings for a home, planning for a family, or looking closely at investments for future security. The core features, like monitoring bills and seeing where every dollar goes, are useful for anyone who wants to be more aware of their financial picture. So, in a way, the "age" of the person using Albert doesn't really limit its usefulness. It's a tool that adapts to different financial journeys, providing a steady hand for anyone looking to improve their money situation. It's quite versatile, actually, for diverse financial needs.

Getting Started with Albert - A Simple Step for Any Age

Getting started with this helpful Albert service is, frankly, a pretty straightforward process. To create your account, you simply need to get the Albert app onto your mobile phone. You can find it easily in your phone's app store, whether you use an Apple device or an Android one. It's designed to be quite accessible, so the steps are clear and easy to follow for most people. This ease of access means that, you know, it doesn't matter if you're super tech-savvy or just learning your way around a smartphone; the process is set up to be as painless as possible. This simplicity is a big part of what makes it so appealing to such a large number of users, from various age groups and backgrounds.

Once you have the app on your phone, to get yourself registered, you just open it up. The app will then guide you to put in your name, your email address, and then to choose a secure password. That's really all there is to it to begin your journey with Albert. The focus is on making the initial setup quick and without fuss, so you can get right to the good stuff: managing your money. This simple entry point means that even if you're, let's say, a little hesitant about trying new apps, this one makes it very easy to take that first step. It's a very welcoming process, actually, for new users.

What Does Albert Offer - Beyond Just Saving Money at Any Age?

Albert offers quite a bit more than just a place to put your extra cash. While putting money aside is certainly a big part of what it does, it goes further to give you a more complete picture of your financial world. For instance, it helps you keep a close eye on your bills, making sure you know what's due and when. It also tracks your cash flow, showing you exactly where every single dollar is going. This kind of detailed insight is incredibly helpful for anyone, no matter their age, who wants to feel more in charge of their spending. It's about bringing clarity to your financial movements, which can sometimes feel a bit murky without the right tools. You know, it really helps to see things clearly.

Beyond just watching your money move, Albert also helps you put money away automatically. It can do this based on your income and how you spend, which takes a lot of the guesswork and effort out of saving. You can also earn a good annual percentage yield with its high-yield savings options, which means your money can grow while it sits there. Plus, it lets you create your very own savings goals, whether you're putting money aside for a new car, a vacation, or a rainy day. These features work together to create a pretty comprehensive system for managing your money, making it more than just a simple savings tool. It's really about building better financial habits over time, for all ages, and it's quite effective at that.

Albert's Place in the Financial Scene - Not a Bank, But What Then?

It's important to be clear about what Albert is and what it isn't. The service is not, in fact, a bank. This distinction is pretty important to grasp. While it helps you with many things that banks also deal with, like saving and spending, it operates a little differently. Instead, the banking services that come with using Albert are actually provided by Sutton Bank, which is a member of the FDIC. This means that your money, when handled through Albert's associated banking services, is protected by federal deposit insurance, just like it would be at a traditional bank. This structure means Albert focuses on the software and the financial guidance, while a regulated bank handles the actual money holding. It's a very common setup in the world of financial technology, you see.

This kind of arrangement allows Albert to concentrate on what it does best: providing smart tools and insights for managing your money. They are the ones who build the easy-to-use app, the budgeting features, and the automatic saving mechanisms. The partnership with Sutton Bank ensures that the underlying financial transactions and the security of your funds are handled by an institution that specializes in that. So, in essence, Albert acts as your personal financial assistant, offering guidance and tools, while the banking side is managed by a separate, regulated entity. It's a way to offer comprehensive financial support without being a full-fledged bank itself, which is actually quite clever.

Keeping Tabs on Your Spending - A Smart Move for All Ages

One of the really strong points of the Albert service is its ability to help you keep a close watch on your spending. It's a pretty smart move for anyone, truly, no matter how old they are or how much money they have. The app is set up to help you budget and track where your money goes, giving you a clear picture of your financial habits. This means you can easily monitor your bills, see your cash flow in action, and understand exactly where every single dollar of your earnings is being spent. This level of detail can be incredibly eye-opening for many people, as it helps them spot areas where they might be able to save a little more or spend a little less. It's very empowering to have that kind of insight, actually.

Understanding your spending patterns is a foundational step to gaining real control over your money. Without knowing where your money is going, it's almost impossible to make informed decisions about saving or investing. Albert helps bridge that gap by providing a simple, visual way to see your financial movements. It can highlight recurring expenses, show you categories where you might be overspending, and generally make you more aware of your financial behavior. This awareness, in turn, can lead to much better money habits over time. It's a bit like having a detailed map of your money journey, which is invaluable for anyone looking to improve their financial health, regardless of their current financial "age" or experience.