Many people, it seems, are curious about "albert blaya sensat twitter" and what that might mean for them. You might be looking for information about someone, perhaps a public figure or a creator, and checking out their online presence. It's quite common, you know, for folks to search for names along with social media platforms, just to see what pops up. Sometimes, though, what you find isn't exactly what you expected, or it leads you down a slightly different path.

When you type in a name like "albert blaya sensat twitter," you're probably hoping to connect with a specific individual, to see their thoughts or updates shared online. Yet, in the vastness of the internet, sometimes a name can bring up other things, perhaps a product or a service that shares a similar sound or spelling. This can be a little surprising, but it's part of how information flows these days, as a matter of fact.

So, if your search for "albert blaya sensat twitter" has, by chance, brought you here, you might be interested to hear about something that could genuinely help you handle your money. While we can't speak to a specific person's social media, we can share details about a very popular financial tool that's helping lots of folks get a better grip on their personal funds. It's called Albert, and it's quite a thing, honestly, for anyone wanting more control over their financial picture.

Table of Contents

- What's the Story with Albert Blaya Sensat and Social Media?

- Taking Charge of Your Money - Is Albert the Right Fit?

- How Does Albert Help You Handle Your Spending?

- Can Albert Really Make Saving Easier?

- What You Should Know About Albert's Structure?

- Getting Started with Albert - What's the Process?

- Albert's Reach - Who's Using It?

- Albert Blaya Sensat - Personal Details?

What's the Story with Albert Blaya Sensat and Social Media?

You're looking for information related to "albert blaya sensat twitter," and that's a pretty specific query. Sometimes, a name might sound familiar, or you might have heard it somewhere, prompting you to look it up online. It's like, you're trying to piece together a puzzle, right? The internet is a big place, and names can be shared by many different things or people. In this particular case, while the search term points to a person and a social media site, the information we have on hand actually speaks to a popular financial tool. So, too it's almost as if the name has a double meaning, or perhaps there's a bit of a mix-up in the search results. This financial tool, Albert, might be something that comes up if you're exploring ways to manage your money, even if your initial search was for something else entirely. It’s an interesting way that information can connect, even when it’s not exactly what you set out to find, you know?

Taking Charge of Your Money - Is Albert the Right Fit?

Many people want to feel more in control of their money, to really get a handle on where it goes and how it grows. It's a common desire, to be honest. The Albert app is one way that more than ten million people are trying to do just that. It brings together several different money activities into one place. You can keep track of your spending, put money aside for later, make purchases, and even put some funds to work for you, all within this one quite capable tool. It's designed to give you a single spot to see your whole financial picture, which can feel really helpful when you're trying to keep things straight. So, if you're someone who likes having all your money stuff in one spot, this app could be something worth looking into, as a matter of fact.

How Does Albert Help You Handle Your Spending?

One of the main things folks often struggle with is knowing where their money actually goes each month. It's easy for little purchases to add up, and then you wonder why your bank account looks a bit lighter than you expected. Albert tries to make this easier for you. It helps you set up a spending plan, or what many call a budget. With Albert, you can keep an eye on your various bills, see how cash moves in and out of your accounts, and basically get a clear picture of every single dollar's journey. This way, you're not guessing anymore; you're actually seeing the details. It's like having a little assistant that points out exactly where your money is going, which can be pretty eye-opening, honestly, for a lot of people.

Can Albert Really Make Saving Easier?

Saving money can feel like a real chore for many of us. It's one of those things we know we should do, but putting it into practice is sometimes a challenge. Albert tries to simplify this by setting up automatic ways to put money aside. It can look at your income and how you spend, then suggest amounts to move into savings for you, all on its own. You can also earn a good return on the money you save with its high-yield savings option. Plus, if you have specific things you're saving for, like a vacation or a new gadget, you can set up special goals within the app. This means the app works a bit like a helpful hand, gently nudging your money into savings without you having to think about it every single day. It's a pretty neat way to build up your funds over time, in a way.

What You Should Know About Albert's Structure?

It's always a good idea to understand how a financial service operates, right? Albert, the app, is not what you would call a bank in the traditional sense. It doesn't hold a banking license itself. Instead, it works with another institution to provide those kinds of services. Specifically, the banking services you get through Albert are actually provided by Sutton Bank. This bank is a member of the FDIC, which means your money held in those accounts is insured up to certain limits. So, while you interact with Albert for your day-to-day money management, the underlying financial safety net comes from a regulated banking partner. It's just good to be clear about that distinction, you know, for peace of mind.

Getting Started with Albert - What's the Process?

If you're thinking about giving Albert a try, getting set up is pretty straightforward. The first step is to get the app onto your mobile phone. You'll find it in your phone's app store, whether you use an Apple device or an Android one. Once you have the Albert app downloaded, you just open it up to begin the registration process. You'll need to put in your name, your email address, and then choose a password that's strong and secure, something that keeps your account safe. It's a simple series of steps, really, designed to get you up and running without too much fuss. And you can try out a plan for a full thirty days before any charges come your way, which is a nice little bonus, you know?

Albert's Reach - Who's Using It?

It's pretty impressive to think about how many people are already using Albert. The numbers tell a story of wide acceptance and trust. More than ten million people have already decided to join the Albert community. That's a lot of folks who are finding value in what the app offers for managing their money. When you see numbers like that, it suggests that the tool is doing something right for a broad group of users. It means a lot of different people, with different money situations, are finding it helpful for their personal finances. So, it's clearly struck a chord with a significant portion of the population looking for better ways to handle their funds, apparently.

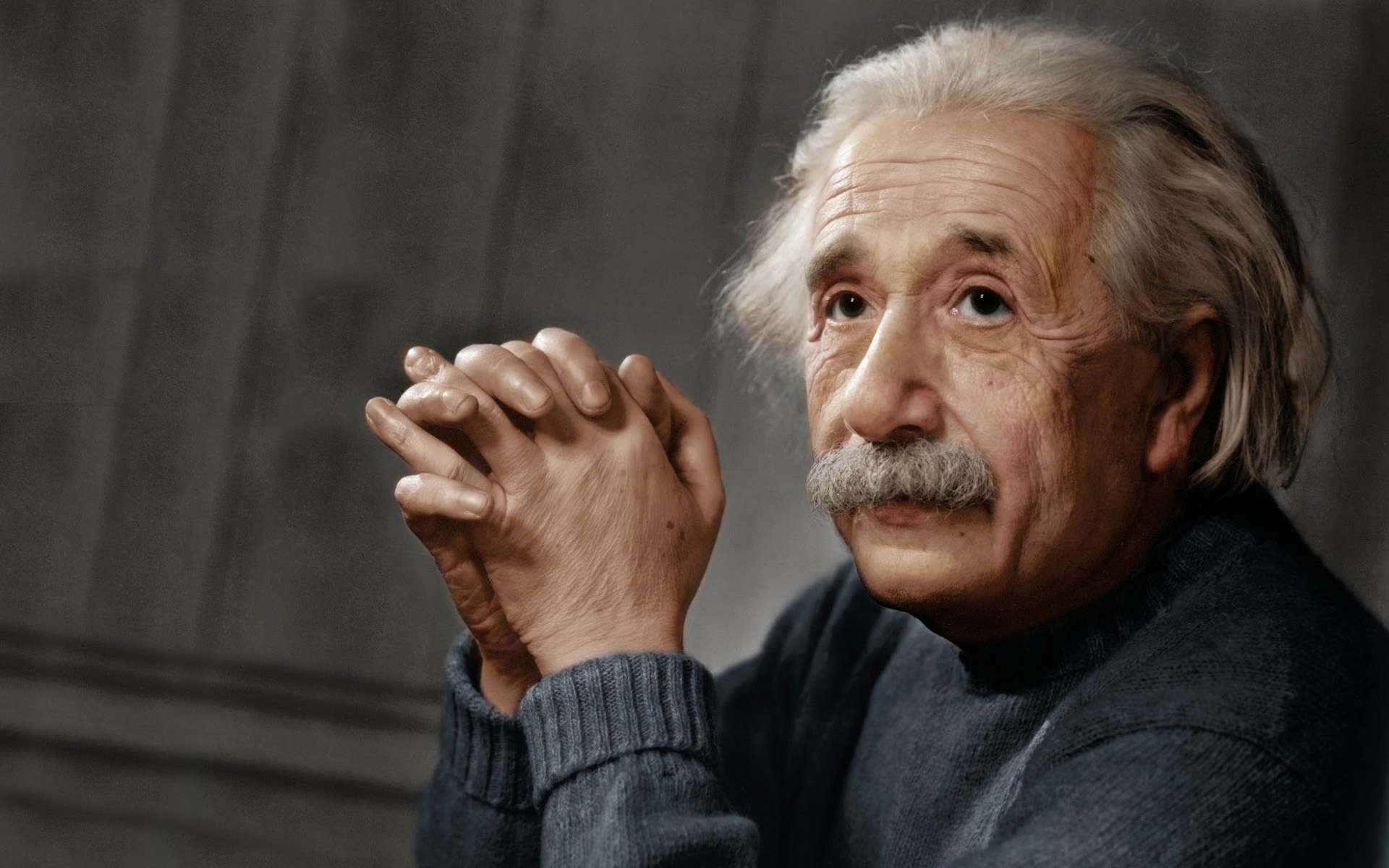

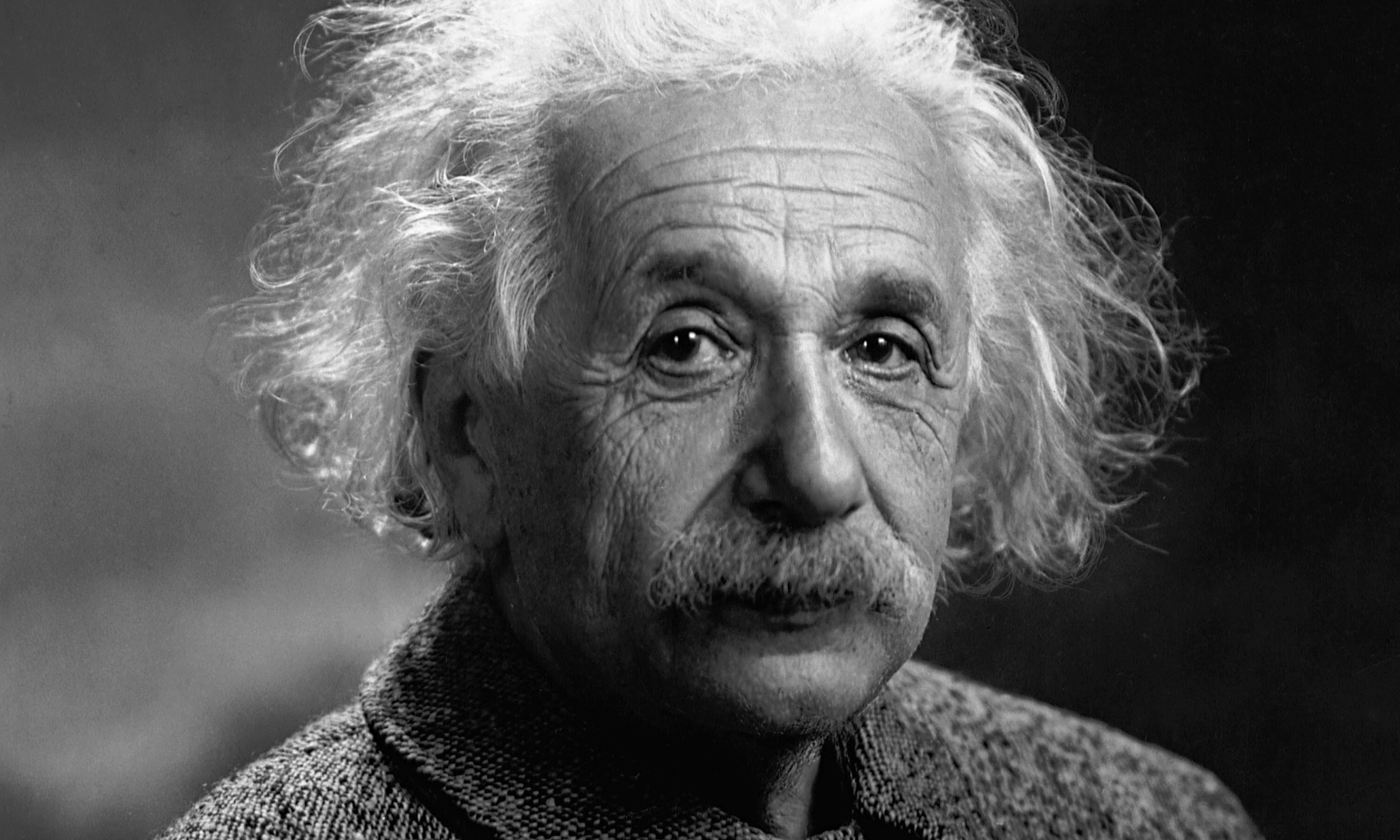

Albert Blaya Sensat - Personal Details?

When you're searching for someone like "albert blaya sensat twitter," you might be hoping to find biographical information, perhaps a table with their birth date, career highlights, or other personal details. However, the information provided for this article, which is about the financial app named Albert, does not contain any personal details about an individual named Albert Blaya Sensat. Therefore, it's not possible to create a biography or a table of personal data for this specific name based on the source material given. This article focuses on the features and operations of the Albert financial app, which is what the provided text describes, in fact.

In short, the Albert app offers a way to take charge of your money, helping you budget, save automatically, and track your spending. It connects you with banking services through Sutton Bank, and you can get started by downloading the app and setting up your account. Many millions of people are already using it to help with their finances, and you can try it out for a month before committing to a plan.